by Greg Mulkey

The failures of Silicon Valley Bank and Signature Bank in March of 2023 garnered national attention. An issue highlighted with Silicon Valley Bank was the large number of uninsured deposits held by the bank. In light of these failures, many people considered the possibility of their bank failing and whether their money would be insured or at risk of being lost.

The Federal Deposit Insurance Corporation (FDIC) insures deposits at FDIC-insured banks to help protect depositors in the event a bank fails. The common account types covered by FDIC insurance include checking accounts, savings accounts, money market deposit accounts and certificates of deposit. Investments, such as stocks, mutual funds, and annuities are not FDIC insured. Most people are aware of the general premise that deposits at an FDIC-insured bank are insured up to $250,000.00. Does this mean that deposits can only be insured up to $250,000.00? Not exactly. FDIC deposit insurance covers $250,000.00 per depositor, per FDIC-insured bank, for each account ownership category. It is possible for a depositor to qualify for more than $250,000.00 in FDIC insurance coverage. Accounts owned by a trust are one situation in which a depositor could be insured for more than $250,000.00.

The rules for determining the amount of FDIC insurance coverage for accounts owned by a trust currently differ between revocable and irrevocable trusts. However, effective April 1, 2024, the rules will be the same for both trust types. As of April 1, 2024, trust deposits will be insured up to $250,000.00 per owner (each trust settlor), per each unique beneficiary, up to five beneficiaries, which means a trust’s deposits at an FDIC-insured financial institution could be insured up to $1,250,000.00 per owner. The following are examples of how the rule applies to joint revocable trusts and single settlor revocable trusts in different scenarios.

Example 1 – Husband and Wife are the settlors of a joint revocable trust. The couple’s three living children are equal trust beneficiaries upon the death of both settlors. The revocable trust owns a $2,000,000.00 certificate of deposit (CD) at Insured Bank. For purposes of determining the amount of FDIC insurance coverage, each trust settlor is an owner of the account.

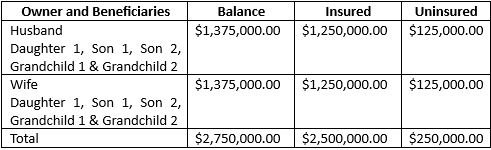

Example 2 – Husband and Wife are the settlors of a joint revocable trust. The couple’s three living children and two living grandchildren are equal trust beneficiaries upon the death of both settlors. The revocable trust owns a $2,000,000.00 CD and a checking account with $750,000.00 at Insured Bank.

Example 3 – Husband is the settlor of a revocable trust. Upon the death of Husband, the trust assets remain in the trust for Wife’s lifetime benefit. Upon the death of Wife, the trust assets will be distributed to Husband and Wife’s three living children in equal shares. The revocable trust owns a $1,000,000.00 CD at Insured Bank.

The examples are provided to illustrate the applicability of the FDIC insurance rules for trusts as of April 1, 2024, based on the facts in each example. You can visit the FDIC’s Electronic Deposit Insurance Estimator (EDIE) at https://edie.fdic.gov/calculator.html to see how the FDIC insurance rules and limits apply to your covered accounts.